why is pfizer stock so cheap

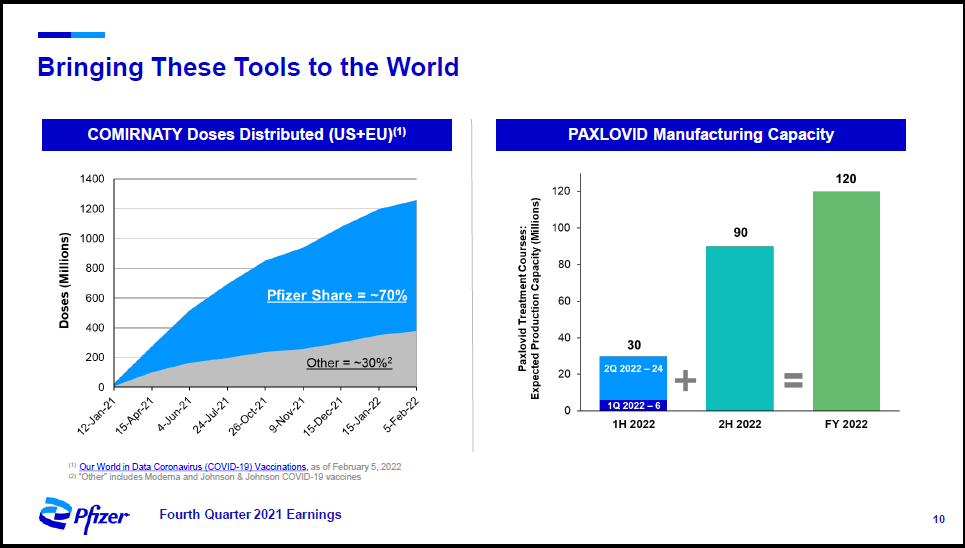

Because it will be the one that creates the REAL vaccine. Now lets address it.

Does The Current Dip In Pfizer Stock Offer A Buying Opportunity

The company reported revenue of 2384 billion and adjusted earnings of 108 per share.

. Even if youre 100 convinced that you want to buy the stock you should understand why somebody is selling it to you at this price that youre willing to buy it at. The stock spent much of the last half-decade since 2016 in the 30 to 35 range. They do have quite a few programs in clinical trials and a total of 20 developmental candidates.

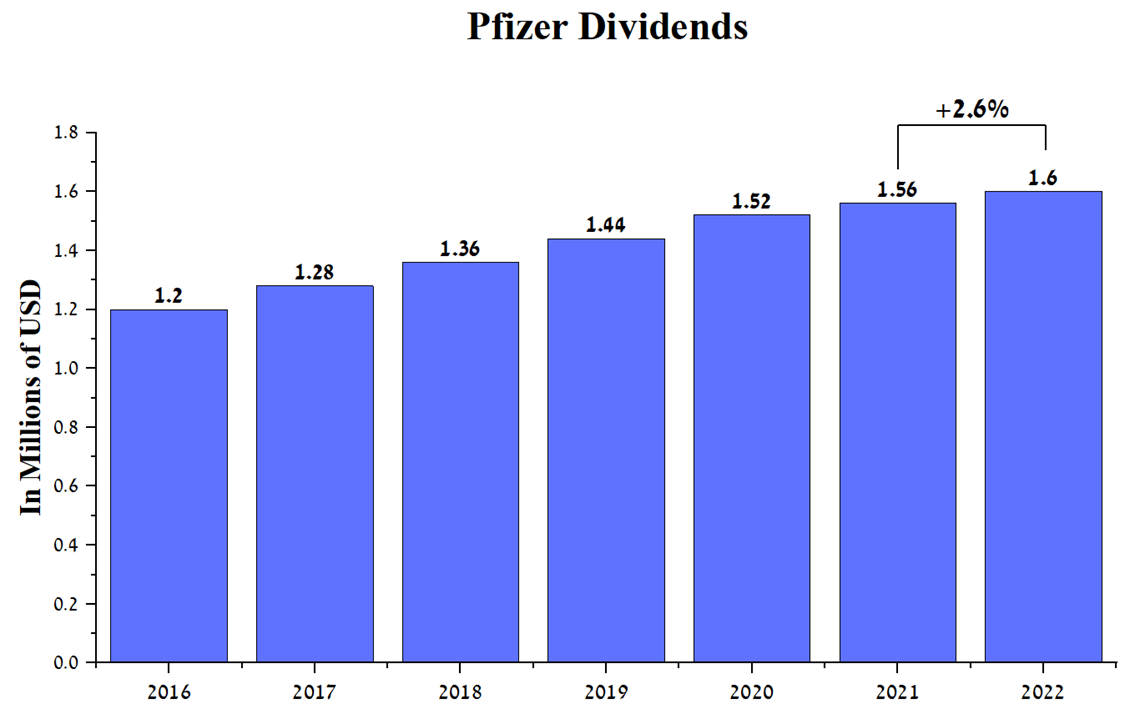

One reason to buy Pfizer stock is its lush dividend yield of 425 more than double that of the SP 500. Thats a lot better than where Pfizer stock was in March but 2020 so far is yet another dismal year. Pfizer Inc PFE-N 18042022 at 0500pm.

Additionally implied volatility is now skewed negative and is pricing in 010 of decline. Pfizer announced that it completed its acquisition of Arena Pharmaceuticals on 11 March 2022 and so Arenas shares of common stock were delisted that day. The growth of a stock is directly proportional to the capital gains one will achieve by holding a stock.

Shares of Pfizer gained downside momentum after the company released its fourth-quarter earnings report. Pfizer PFE 010 recently announced very good first-quarter results. However its share price barely moved.

The question however is why Pfizer stock seems so cheap. Five Stocks That Will Define The Next Decade of Retirement. Its a yield company as in their revenue is no longer growing so you are looking at it from a yield perspective and in this environment that means dividend as earnings is fairly volatile.

Increased revenue and earnings growth combined with a strong dividend should make Pfizer stock more appealing than its been in quite a while. It is cheap changing hands at a. According to Bourla even removing.

Revenue and profits soared. With an average PE at 14X and 2020 earnings estimated between 285 and 305 Pfizer shares are likely worth 40 to 43. Trading at a forward price-to-earnings of around 125 times Pfizer trades in deep value territory.

By headhe fundamentalists selling out and lowering it during massive market booms it makes private investors think it sucks and they sell their positions. The stock has ebbed and flowed roughly between the mid-20s to mid-30s for the last five years. Pfizer trades at a discount to its peers because of its Essential Health unit Pfizers portfolio of older products and generic treatments.

It is also only 116 times. Those concerns have been around for a while now a key. Diversify your portfolio with guidance from investment professionals.

In 2019 Pfizers shares. Shares of Pfizer gained downside momentum after the company released its fourth-quarter earnings report. Why Is Pfizer Stock So Low.

High volumes of covered call writing have beaten down options premiums. The question however is why Pfizer stock seems so cheap. With an average PE at 14X and 2020 earnings estimated between 285 and 305 Pfizer shares are likely worth 40 to 43.

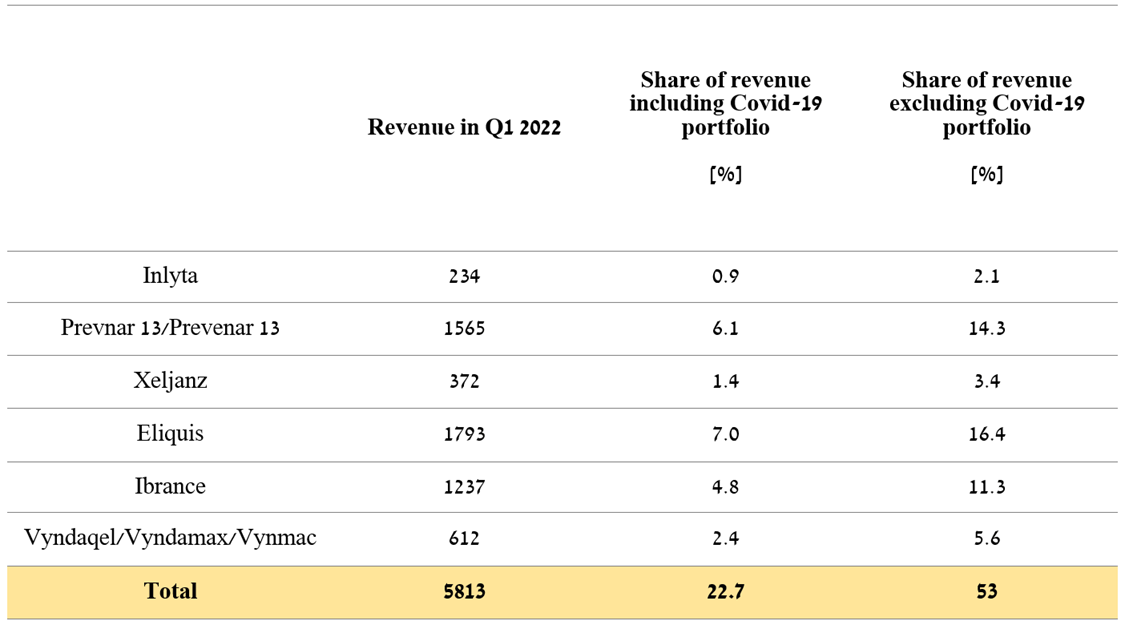

Pfizer is very cheap much cheaper than most of the other vaccine stocks. PFE is now cheaper than its drug stock peers. Pfizer is a much bigger company with numerous meds on the market and others in the pipeline.

Moreover a 12-18 month price target at 40 is not unreasonable because. I think there are maybe three. So yes Pfizer is cheap at the moment but there are a few risks attached.

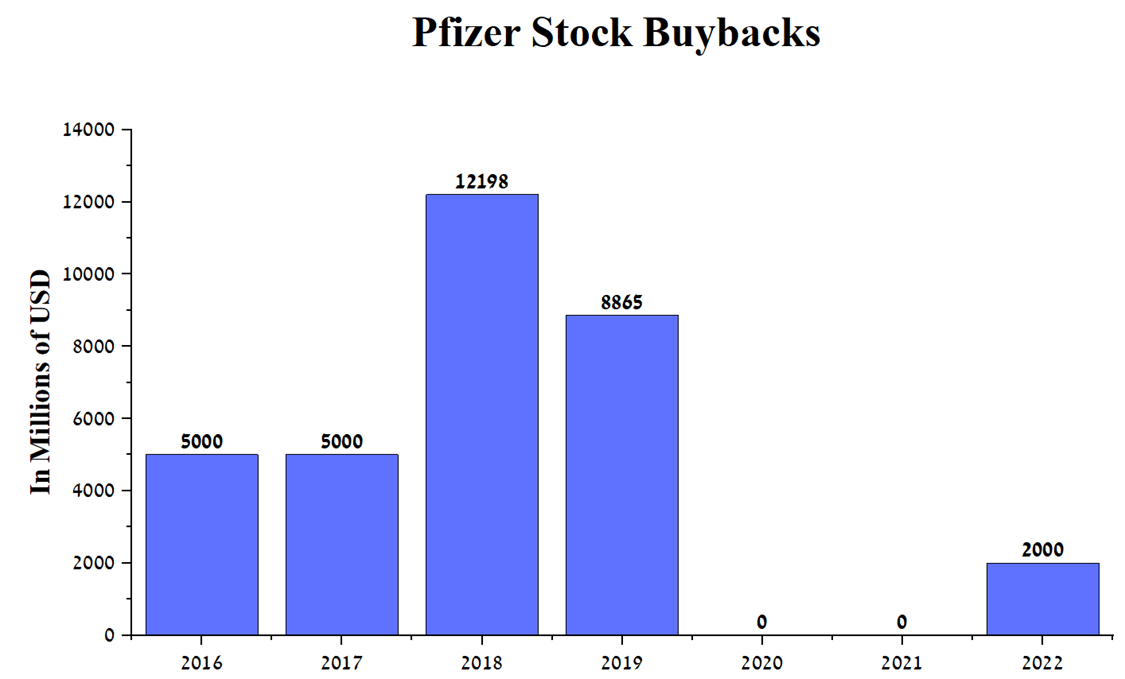

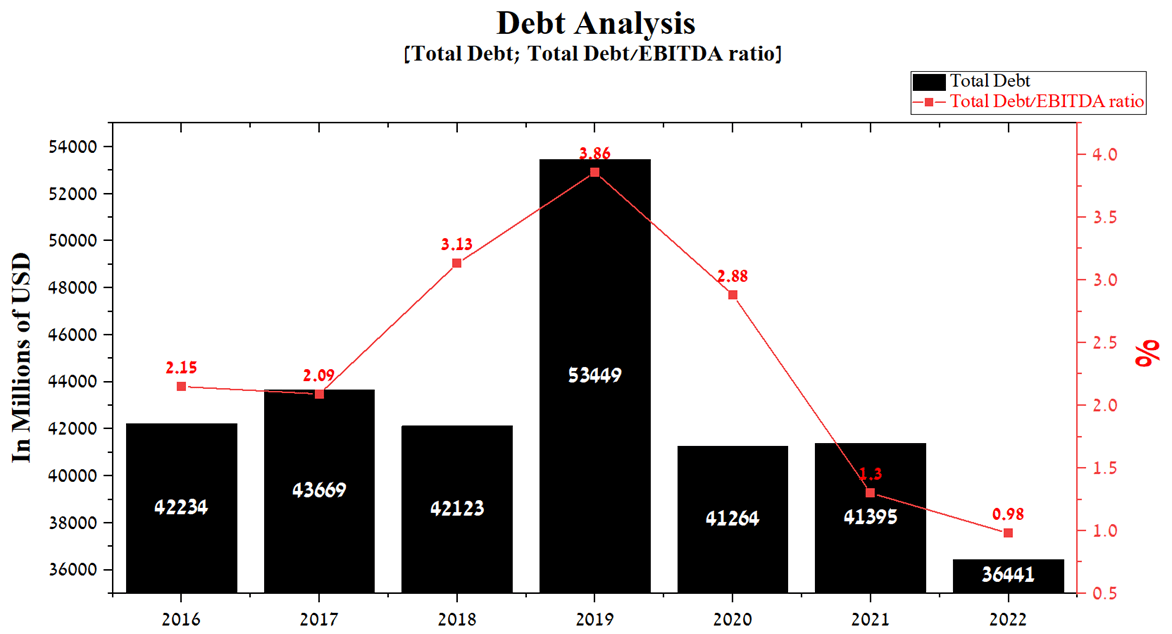

Second the company has now gone five quarters without raising its dividend. So all in all is PFE stock a buy. And finally it has a ton of debt weighing in at around 170 billion.

It also means the stock is cheap based on that 60 billion in sales and 315 earnings-per-share EPS estimate. A perfect storm has battered the New York-based drug makers fortunes of late with rising concerns surrounding President Joe Bidens Medicare cost cutting plans uncertainty over the need for Pfizers Covid. In fact it hasnt been this cheap in a while.

Its actually 11 from what I see on yahoo. So a few reasons why their pe is so low. Ad With Best-in-Class Trading Tools No Hidden Fees Trading Anywhere Else Would be Settling.

For example right now PFE stock trades for just 13 times expected EPS of 286 for 2020. Moderna has no med that has been approved for distribution yet. And the answer seems to be based on very real concerns about the Pfizer business.

Ad Five Under-The-Radar Investments You Cant Afford to Miss. So when it finally does pop there is more money to be made by big firms. So a few reasons why their pe is so low.

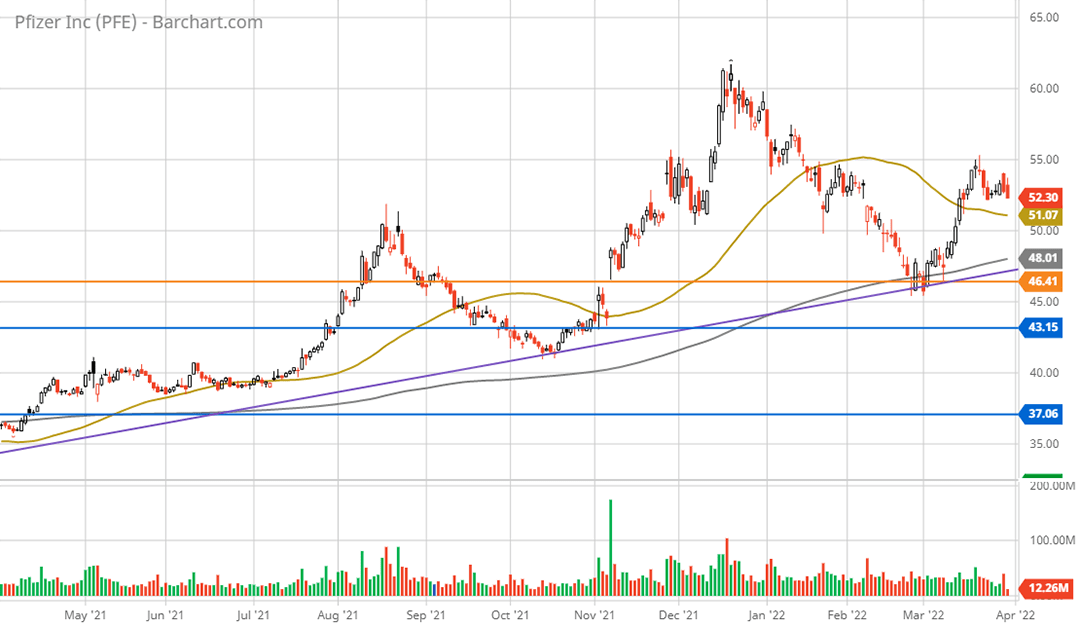

Shares in the American pharmaceutical corporation Pfizer PFE are currently trading 17 down from their all-time August closing highs of 5042. The big drugmaker even raised its full-year guidance. First T stock is down big this year off 273 in 2020 while the SP 500 is up 155.

Ad 3 stocks The Motley Fool is doubling down on in 2022. Answer 1 of 5. It also means the stock is cheap based on that 60 billion in sales and 315 earnings-per-share EPS estimate.

Volatility on Pfizer is very cheap. Pfizer Stock Is Cheap Relative to Its Peers. Shares of the big drugmaker are still down close to 5 year to date.

Michael OReilly PFE has a long pipeline of new drugs focusing on oncology rare diseases and vaccines generating over 50.

Pfizer Pfe How It Could Double Seeking Alpha

Why Pfizer Stock Is Catching Fire Today The Motley Fool

:max_bytes(150000):strip_icc()/2-c76254839cdd45a596956aa6e11b5405.jpg)

Pfizer Positioned For Future Upside

How To Buy Pfizer Stock In July 2022

How To Buy Pfizer Pfe Stock Forbes Advisor

Pfizer Pfe Stock Price News Info The Motley Fool

:max_bytes(150000):strip_icc()/1-d656e003d5bb4c5f849f55b3e2b4deb6.jpg)

Pfizer Positioned For Future Upside

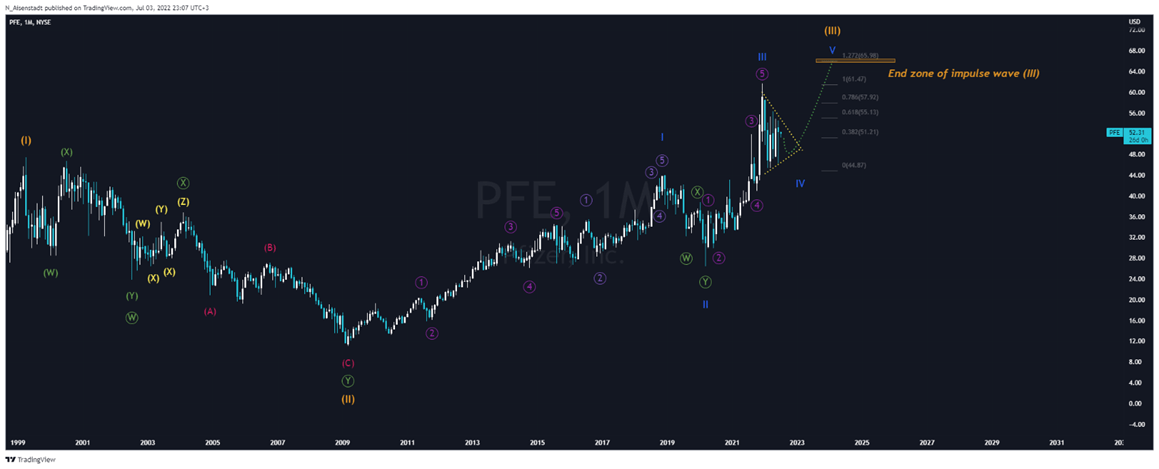

Pfizer Stock In Anticipation Of A New Wave Of Covid 19 Nyse Pfe Seeking Alpha

Pfizer Stock In Anticipation Of A New Wave Of Covid 19 Nyse Pfe Seeking Alpha

Pfizer Stock In Anticipation Of A New Wave Of Covid 19 Nyse Pfe Seeking Alpha

Should You Buy Sell Or Hold Pfizer Stock At 52

How To Buy Pfizer Stock In July 2022

Pfizer Stock Is Pfe Stock A Sell On More Moderate Expectations For 2022 Sales Investor S Business Daily

Pfizer Stock In Anticipation Of A New Wave Of Covid 19 Nyse Pfe Seeking Alpha

:max_bytes(150000):strip_icc()/4-6d6ad667049442be82eba9859b909770.jpg)

Pfizer Positioned For Future Upside

Pfizer Pfe How It Could Double Seeking Alpha

:max_bytes(150000):strip_icc()/3-3a4c5d6eab9c47f9a0cca1daa0f78c42.jpg)

Pfizer Positioned For Future Upside

Pfizer Stock In Anticipation Of A New Wave Of Covid 19 Nyse Pfe Seeking Alpha