how much is capital gains tax on property in florida

The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your property and how much you sold it foradjusting for commissions or fees. The gain is calculated by taking the sale price less the purchase price and all.

Florida has no state income tax which means there is also no capital gains tax at the state level.

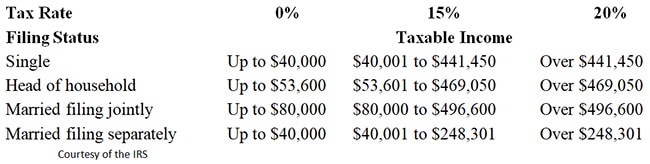

. Current income tax brackets for are. Capital Gains Tax Rate. Individuals and families must pay the following capital gains taxes.

The estimated sale price of the property is 134400 therefore the capital gain is 74910 after tax. 12 on income between 9950 and 40525. Subtract your adjusted basis from the purchase price of the property then multiply it by the capital gains tax rate in effect from taxable income.

Capital gains tax is payable on the net gain from the sale of property. The tax percentage on a short-term gain is the same as the rate that applies to your taxable income outside the gain. 1 day agoHow Is Capital Gains Calculated On Sale Of Rental Property Calculator.

Depending on your income level your capital gain will be taxed federally at either 0 15 or 20. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. How much are capital gains taxes on real estate in Florida.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. 205000 x 15 30750 capital gains taxes. Defer Capital Gains Tax by using 1031 Exchange.

This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale. The most common capital gains are realized from the sale of stocks bonds precious metals and property. Payable on the net gain of your property to the IRS.

Income over 40400 single80800 married. How much is capital gains tax on real estate in florida. Florida Real Estate Taxes What You Need To Know What Is A 1031 Exchange Capital Gains Tax Capital Gain Investing 2021 And 2022 Capital Gains Tax Rates Forbes Advisor.

If the asset is owned for greater than one year capital gains tax rates are applied to the amount of gain zero for gains that would otherwise be taxed at the 10 or 15 rates 15 for gains that would be taxed at the 25 28 33 or 35 and 20 for gains that would be taxed at the 396 rate. Again this varies based on whether the money comes from short-. FIRPTA Withholding 15 of gross sale price of property Long Term and Short Term Gain.

If you earn money from investments youll still be subject to the federal capital gains tax. The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your property and how much you sold it for adjusting for commissions or fees. 20 CGT rate 28 for.

Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. Income over 445850501600 married. Depending on your income level your capital gain will be taxed federally at either 0 15 or 20.

You have lived in the home as your principal residence for two out of the last five years. When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation. 22 on income between 40525 and 86375.

10 CGT rate 18 for residential property for individuals entire capital gain if overall annual income is below 50270. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. If youre single for example the following brackets are in effect in 2022 for 2021 taxes.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. 10 on income of less than 9950. Ncome up to 40400 single80800 married.

Capital Gains Tax.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

12 Ways To Beat Capital Gains Tax In The Age Of Trump

The States With The Highest Capital Gains Tax Rates The Motley Fool

What Is A 1031 Exchange Capital Gains Tax Capital Gain Investing

Cornering The Market Rental Income Advisors Rental Income Capital Gains Tax Rental

Florida Real Estate Taxes What You Need To Know

Real Estate Tax Tips Youtube Real Estate Sales Real Estate Estate Tax

Capital Gains On Selling Property In Orlando Fl

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Tax Calculator 2022 Casaplorer

House Maintenance And Improvements Records Aboutone Real Estate Real Estate Courses Real Estate Signs

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Pin On Blogging Lifestyle Best Of Pinterest Group Board

What Is Capital Gains Tax And When Are You Exempt Thestreet

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The Capital Gain On A Rental House Is 167 918 They Were Told They Will Pay About 96 000 In Taxes They Are Retired And Low Income Should They Get A 2nd Opin

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe